Freezone License

UAE FREEZONE LICENSE LOCATIONS AND PRICING

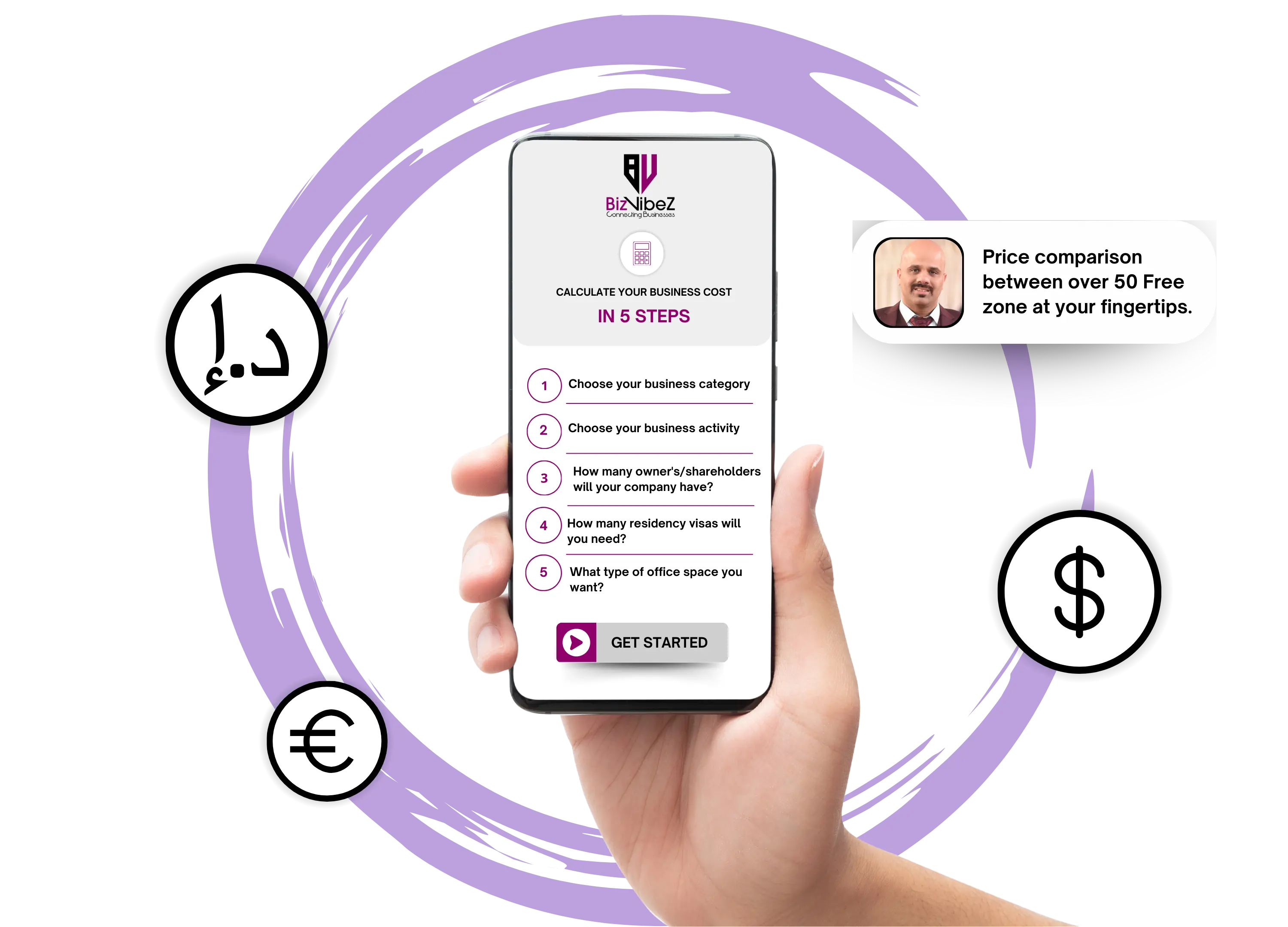

Choosing a strategic freezone location and understanding its costs are critical factors for a business in the United Arab Emirates. We provide detailed insights into the various freezone options available for your business.

Find Your Freezone License Today!

Home>

Services>

Freezone License

Choosing the right freezone location and understanding the associated costs are critical factors in setting up a successful business in the UAE. Each freezone offers unique advantages, from strategic geographic locations to sector-specific benefits, along with varying pricing structures. Our services offer detailed guidance on navigating these choices, ensuring you find the ideal location and cost framework for your business.

MUST KNOW

Cost Transparency: A detailed breakdown of all costs for a freezone license is available, including initial setup fees, annual renewal fees, and any additional costs. This information helps with effective budget planning.

Location Benefits: Each UAE freezone offers unique benefits based on its location. The team assists you with understanding these advantages, like proximity to airports, to ensure a strategic choice for business operations.

Processing Time Obtaining a license can have varying processing times depending on the freezone and the nature of the business activity. The typical duration is 7 to 10 working days.

Understanding the Freezone Business Concept

UAE Free Trade Zones are specific geographical areas where mainland taxes and most import-export restrictions on businesses do not apply. Foreign investors find these special economic zones attractive because they offer a pro-business regulatory environment. A business entity operating in a UAE Free Trade Zone enjoys numerous incentives not available to mainland companies. This makes a freezone company formation a highly attractive proposition for many international investors looking to enter the regional market. Companies in these zones receive full support from the freezone authority.

Choosing a Strategic Free Zone Location

Selecting the right freezone is foundational for the long-term success of any business operation. With more than 50 different free zones across the Emirates, each with its own regulations and industry focus, making an informed choice requires a deep knowledge of the market. For instance, businesses in the logistics sector will greatly benefit from excellent port connectivity found in Jebel Ali Free Zone (JAFZA). Conversely, companies operating in the financial services sector might prefer the specialized regulatory framework of Abu Dhabi Global Market (ADGM) or Dubai International Financial Centre (DIFC).

The location of a freezone matters immensely as it determines proximity to key markets, airports, and seaports. A business serving the local market may choose a free zone in a central location, while an import-export company needs close access to major shipping routes. Our business setup team carefully considers all these factors to recommend the optimal place to register your specific business in the UAE.

Key Advantages of a Freezone Business License

Acquiring a freezone license provides numerous benefits, which can certainly enhance a business's operational capabilities and market presence. These advantages create a highly competitive environment for international businesses that seek a strong regional base.

- 100% foreign ownership of the company and full repatriation of all capital and profits for maximum financial returns are guaranteed.

- Tax exemptions on import and export duties can significantly reduce operational costs for companies looking to expand their market presence.

- Streamlined customs procedures help to expedite the efficient movement of goods and save valuable time and effort for your logistics.

- The absence of foreign exchange controls and currency restrictions provides a high level of financial flexibility for international transactions.

- Businesses gain access to a multicultural workforce and a streamlined process for obtaining residence visas for employees and investors.

- Certain free zones offer specialized facilities and world-class infrastructure, which is a major benefit for specific industries.

- Companies operate within a secure, business-friendly legal environment that has its own independent authority and regulations.

Detailed Financial Breakdown for Freezone Setup

Acquiring a freezone license provides numerous benefits, which can certainly enhance a business's operational capabilities and market presence. These advantages create a highly competitive environment for international businesses that seek a strong regional base.

- 100% foreign ownership of the company and full repatriation of all capital and profits for maximum financial returns are guaranteed.

- Tax exemptions on import and export duties can significantly reduce operational costs for companies looking to expand their market presence.

- Streamlined customs procedures help to expedite the efficient movement of goods and save valuable time and effort for your logistics.

- The absence of foreign exchange controls and currency restrictions provides a high level of financial flexibility for international transactions.

- Businesses gain access to a multicultural workforce and a streamlined process for obtaining residence visas for employees and investors.

- Certain free zones offer specialized facilities and world-class infrastructure, which is a major benefit for specific industries.

- Companies operate within a secure, business-friendly legal environment that has its own independent authority and regulations.

Navigating the Licensing and Application Process

The process for obtaining licenses can vary significantly depending on the freezone and the nature of the business activity. You must first select your desired business activity and the type of license you need. You will then need to reserve your company name and secure its initial approval from the freezone authority. Following this, you must prepare a comprehensive set of documents for submission. These documents include passport copies of all shareholders and the manager, a duly filled application form, and a no-objection certificate if applicable. Once the application receives approval, you will pay the necessary fees and receive your new business license.

The visa application process is a separate but equally important step that occurs after the license is issued. The business will apply for an establishment card, followed by entry permits and residence visas for its investors and employees. This process also involves a medical examination and an application for the Emirates ID card. The entire procedure, from initial application to final visa stamping, is often handled efficiently by the free zone authorities.

Critical Considerations for Long-Term Business Success

Selecting an appropriate freezone is crucial for the future growth and long-term sustainability of any business operation. Our team provides a comparative analysis of major free zones. The right choice ensures your company has a scalable foundation to adapt and expand in the competitive market. For instance, businesses in the trading and logistics sector benefit from Jebel Ali Free Zone’s excellent connectivity to international shipping lanes. Financial service companies might prefer the highly specialized regulatory framework of Abu Dhabi Global Market and its business environment.

Additionally, factors such as a free zone’s reputation, its community of businesses, and the availability of specific facilities are very important. Some free zones have a strong focus on a particular industry, creating a valuable ecosystem and networking opportunities for members. It is essential to choose a free zone that not only fits your current needs but also supports your future business objectives. We offer guidance to ensure a decision supports business growth and long-term sustainability.

Contact Us for a Consultation

Our business setup team is ready to provide insightful advice on company formation in the UAE. The typical timeframe for obtaining a license ranges from 7 to 10 working days. Contact us today to begin your company formation journey. Our team will assist you with every stage of the process, from initial consultation to the final issuance of your license.